Candlestick Patterns The Definitive Guide (2021)

The 3 Bar Play Pattern is a popular candlestick formation used by traders to identify strong momentum breakouts in either direction. This pattern consists of two smaller bars followed by a large third bar, indicating a sharp increase in buying or selling pressure.

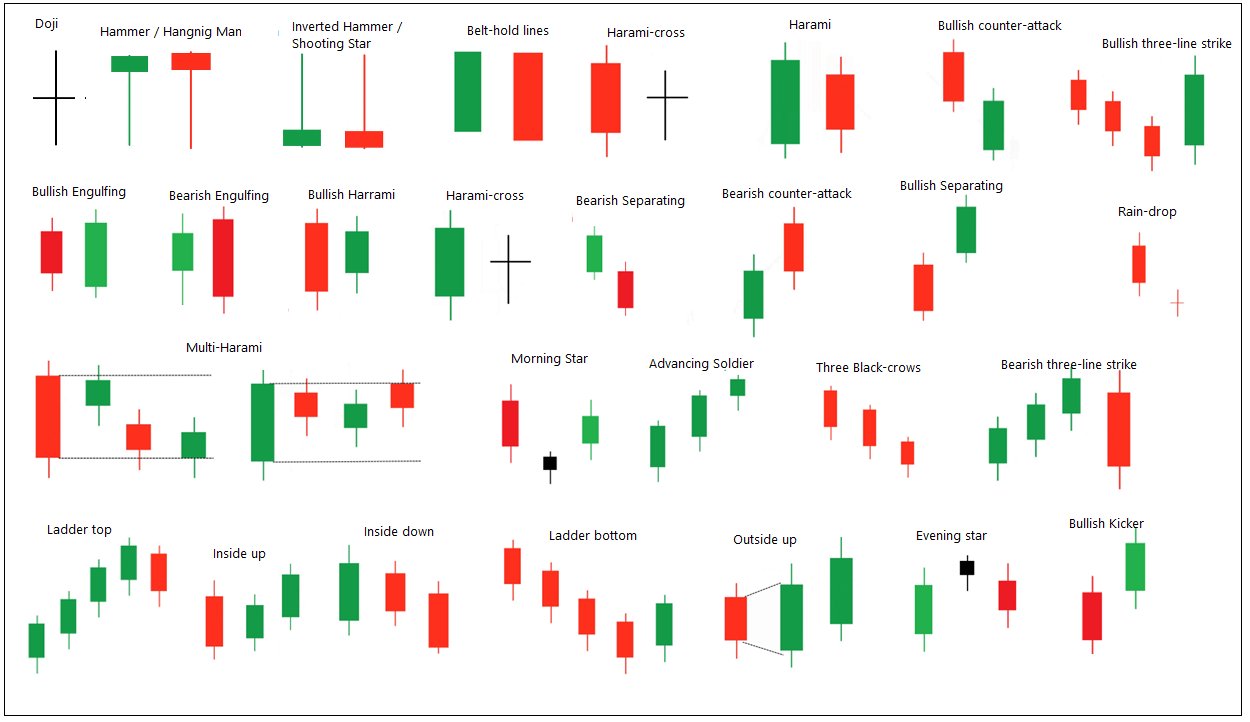

Candlestick Pattern Book Candlestick Pattern Tekno

A tri-star is a three line candlestick pattern that can signal a possible reversal in the current trend, be it bullish or bearish. Tri-star patterns form when three consecutive doji.

3 candlestick patterns outlet factory shop

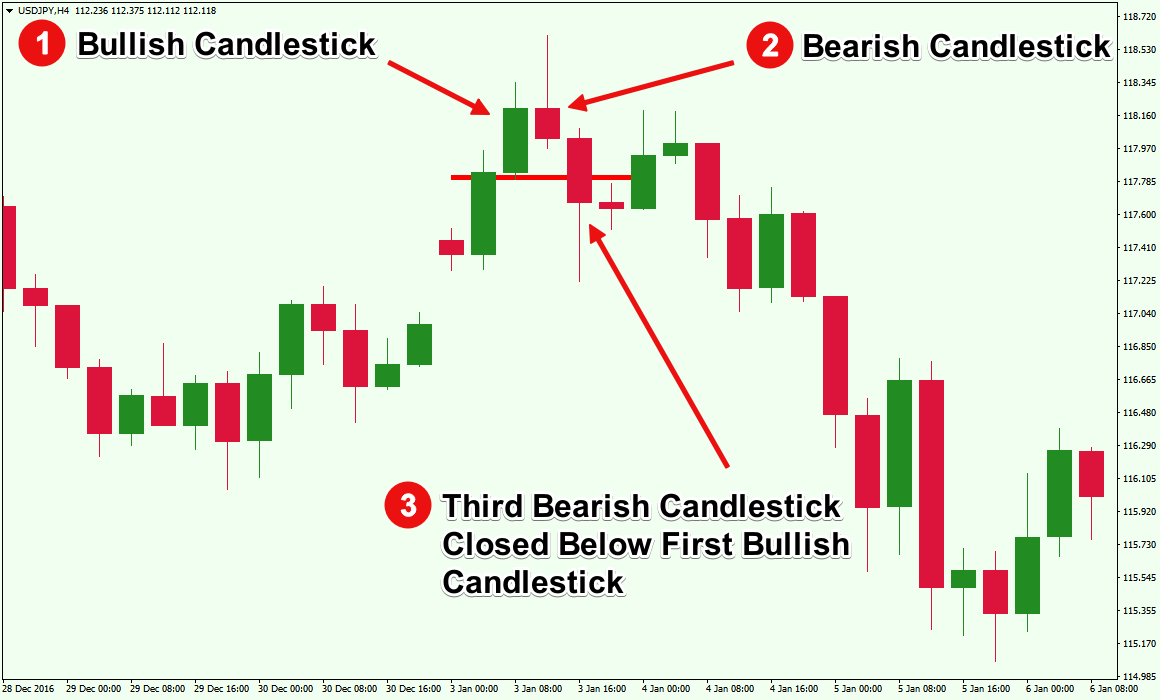

The Three Line Strike candlestick pattern is a 5-bar continuation pattern. The bullish formation is composed of a big green candle, 3 up candles, and one down candle erasing the advance made by the prior 3 candles.

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

According to Investopedia.com, it is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century.His name was Munehisa Honma. 2 Honma traded on the Dojima Rice Exchange of Osaka, considered to be the first formal futures exchange in history. 3 As the father of candlestick charting, Honma recognized the impact of human emotion on markets.

Bullish Rising Three Methods Candlestick Candle Stick Trading Pattern

The three crows pattern, also referred to as the "three black crows", is a reversal pattern found at the end of an uptrend. The three crows pattern forms as follows: It consists of three consecutive bearish candlesticks. The bodies of the second and the third candlestick should be approximately the same size. They have .

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Preview E Jun 2022 · Your Journey to Financial Freedom Save on Spotify The candlesticks are used to identify trading patterns that help technical analyst set up their trades. These candlestick patterns are used for predicting the future direction of the price movements.

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

Understanding the Three Inside Up/Down Candlestick Patterns The up version of the pattern is bullish, indicating the price move lower may be ending and a move higher is starting. Here are.

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

It is a three-stick pattern: one short-bodied candle between a long red and a long green.

Candlestick Patterns The Definitive Guide [UPDATED 2022]

The three white soldiers pattern can appear after an extended downtrend and a period of consolidation. The first candlestick of the chart pattern that needs to appear is a bullish candlestick with.

MOST COMMON CANDLESTICK PATTERNS for FXEURUSD by Lzr_Fx — TradingView

The Three Inside Up candlestick formation is a trend-reversal pattern that is found at the bottom of a DOWNTREND. This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started. For a valid three inside up candlestick formation, look for these properties:

D Shawna Jackson Evening Star Candlestick Pattern Chartink

The three inside down candlestick pattern is the opposite of the three inside up pattern and indicates a trend reversal found at the end of an uptrend. The following chart shows an example of a three inside down pattern: The first candlestick is long and bullish, indicating that the market is still in an uptrend.

An Overview of Triple Candlestick Patterns Forex Training Group

This 3-candle bullish candlestick pattern is a reversal pattern, meaning that it's used to find bottoms. For this reason, we want to see this pattern after a move to the downside, showing that bulls are starting to take control. When a Morning Star candlestick pattern appears at the right location, it may show:

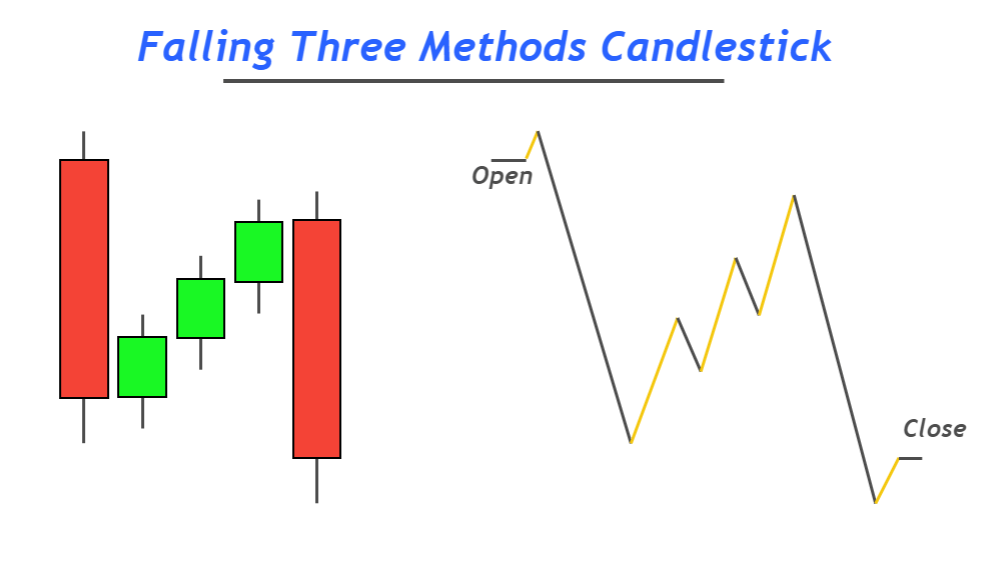

A Complete Guide to Falling Three Method Candlestick Pattern ForexBee

The morning star pattern involves 3 candlesticks sequenced in a particular order. The pattern is encircled in the chart above. The thought process behind the morning star is as follow: The market is in a downtrend placing the bears in absolute control. The market makes successive new lows during this period.

Candlestick Patterns Explained with Examples NEED TO KNOW!

What Is a 3 Outside Up/Down? The three outside up and three outside down are three-candle reversal patterns that appear on candlestick charts. The pattern requires three candles to form.

An Overview of Triple Candlestick Patterns Forex Training Group

https://www.thetradingchannel.com/500offI am looking for 500 new or struggling traders to mentor and help accomplish their trading goals throughout the remai.

How To Trade Blog What Is Three Inside Down Candlestick Pattern

The three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. This chart pattern suggests a strong change in.